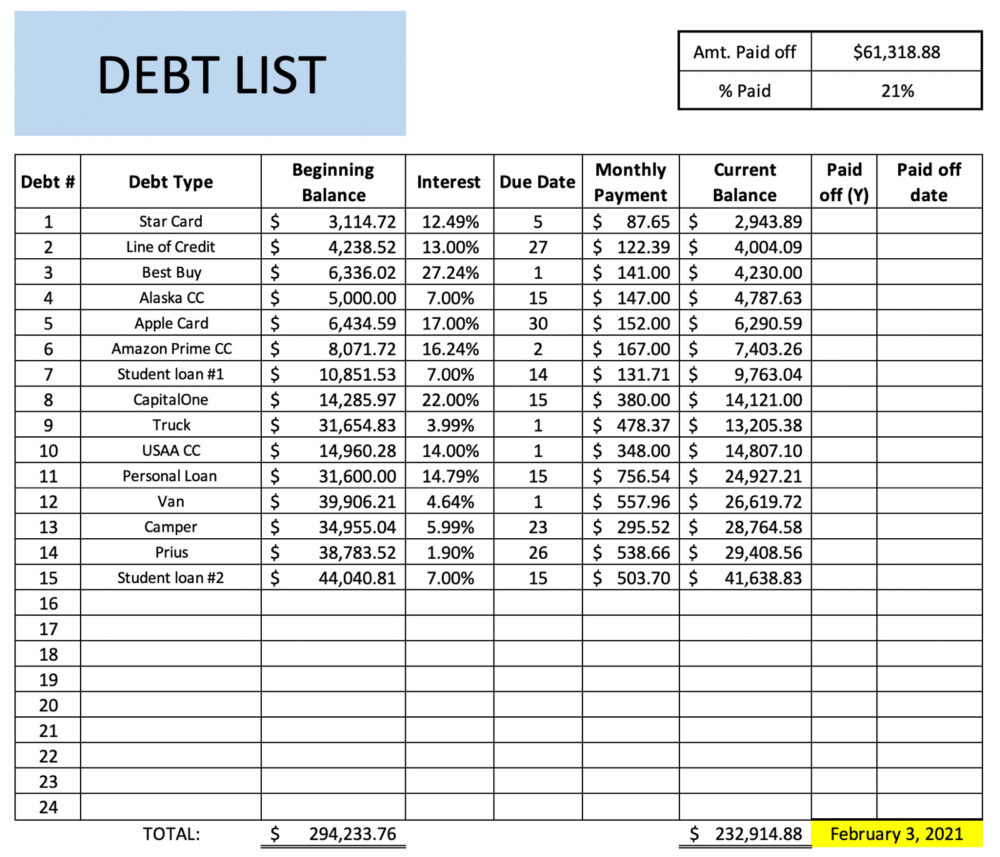

$400 Finance and no Credit score assessment: Just what Credit history Will become necessary?

Regardless of what anxiously you need punctual bucks, you should wait before getting $400 fund without credit assessment. As to why? Because theyre potentially once the predatory given that payday loan. You to completely wrong action will bring you involved for the a period away from debt for years.

More often than not, such money feature rates surpassing eight hundred%. In case the credit rating was from the are prime, you’re going to have to face unpleasing financing conditions.

Bringing $eight hundred Fund with no Borrowing Checks

A credit score assessment has-been an inseparable part of lending functions. This depends on numerous circumstances, such as the preferred financing terminology, an applicants credit prior, a candidates earnings, and so on. Nevertheless, it might not end up being the best selection, because the specific handmade cards offered to those with bad credit need a profit deposit to purchase amount borrowed down the road applicants. (more…)